To help you start saving for your child’s college fund, I’ve rounded up a few apps and tips to help you out. You can see the pros and cons of each and see what will work best for your family situation and budget.

Fabric

This site was built by parents for parents. It offers many different investment options for families, including the very popular 529 educational savings plan. Designed for long-term saving, this plan allows you to save money as you are able and then withdraw the funds tax-free when needed for higher education costs.

Another option is the UGMA custodial account, which is administered by parents or guardians until the child comes of age. The main benefit of opening a UGMA custodial account is that at the age of 18, when your child assumes full ownership of the account, the funds can be used for any purposes. Life plans change and so it’s great to have a flexible plan that doesn’t box you in!

Whichever option you choose, it’s recommended that you begin as soon as possible, to maximize returns on your investments. And make sure you check for additional tax benefits by states that some educational savings plans offer.

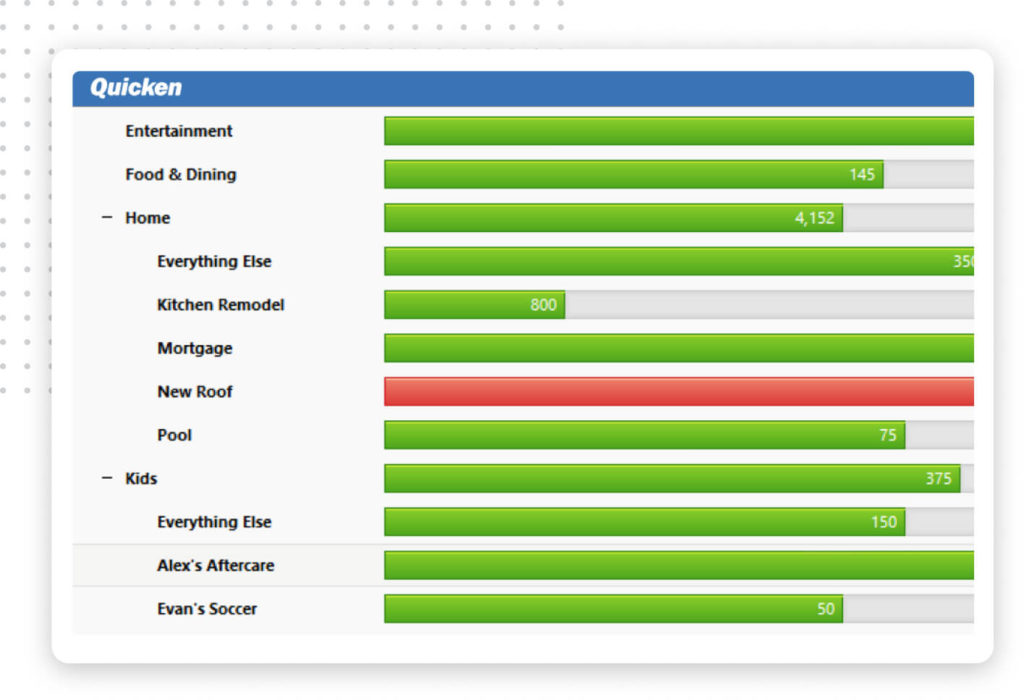

Quicken

If you have trouble setting money aside for college savings, Quicken has helpful strategies. The Quicken Simplifi app allows users create customized savings plans that work within their budget. Using Quicken, you can connect your bank accounts and begin monitoring your spending habits. Then, with the help of Quicken, you can identify areas where you can begin setting aside money for your child’s future college expenses. The app will scan your spending habits and offer helpful ideas for savings.

You will be presented with a comprehensive savings plan with individual goals. From there, you can begin stashing money away for your child’s college education and any other savings goals that you are working toward. Quicken also offers premium options that allow you to pay your bills from within the app as well.

Chime

Saving money without thinking about it—it sounds impossible, right? Well, thanks to Chime it is possible to start setting aside money for your child’s college education without lifting a finger. Chime is a banking app that allows you to open an account completely for free. Using Chime, new parents can make deposits, withdrawals, and build credit all without the fees associated with a traditional bank. This makes it an appealing option for people who have grown tired of monthly banking fees, minimum balances, and overdraft fees. When users take advantage of the automatic savings feature of the application, they can begin saving money for higher education with every purchase and deposit made.

Chime automatic savings works by depositing small amounts of money into your savings every time you use your Chime debit card to make a purchase or any time you make a deposit. The app will round up from your purchase or deposit to the nearest dollar amount and automatically add that amount to your savings. That way, you can go about your life without thinking about saving money. As small deposits add up, you can start establishing a college fund for your child. Even if you aren’t the best at saving money, you can use Chime to get started saving for your child’s future education.

Backer

How about bringing in an investment partner? That’s the idea behind Backer (formerly known as CollegeBacker). This service makes it easy for parents and other family members to contribute to a child’s future. Add other “backers,” and they will become involved in your child’s college savings plans. It’s great for family, godparents or close friends. And everyone can track the savings together.

Check out this review of the Backer app and desktop program.

More Money-Savers

And don’t forget these three tried-and-true ways of saving THOUSANDS of dollars in higher education costs:

- Living at home while going to college

- Working through college

- Applying for as many scholarships as you can – get started early!

For more money-saving college tips, check out Dave Ramsey’s advice.

It’s never too late to get started, so I hope today’s post will be helpful no matter where you are on the path to college savings.

This post was made possible by a partnership with Responsival.

I’ll have to check some of these apps out. I think it’s always a great idea to always start saving money towards collage for kids. My daughters have already started saving up themselves too.

Wow, good for them, Kathy! – Anne Marie

Love this post! I will check a couple of the programs, as they could be yet another way to improve our college savings.