Should you get a 15-year or 30-year mortgage when buying a home? My husband and I chose the former and even though it’s been tough to make the payments sometimes, we’re happy and very confident about the decision.

Here’s why!

You’ll Save HUGE Amounts in Interest

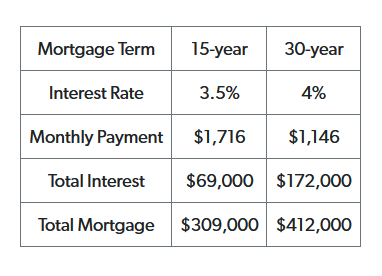

I think this is the number one reason a 15-year mortgage is so great. You save thousands of dollars, and what’s not to like about that? Since you’re borrowing the money for half as long (15 years vs 30 years), the total interest paid will likely be half of what would have been spent.

An online mortgage calculator can show you the impact that different rate terms will have on your monthly payment, and interest paid out over the life of the loan.

Here’s a simple example to put this into focus:

Ask yourself: “Is a smaller monthly mortgage payment worth giving away $100,000 of your money to the bank?” Of course not!

You’ll Probably Get a Better Interest Rate

Fifteen years is a shorter term, making this type of loan cheaper and less risky for a bank to finance than something long-term. You might save as much as a whole point.

My husband and I locked in a great 3% fixed rate back in 2013 when we opted for our 15-year home loan.

You’ll Pay It Off Sooner

Your house will truly be yours 15 years sooner. What a great feeling! Who wants to be a slave to the bank for 30 long years? Wouldn’t it be nice to actually own your home while you’re still raising a family? Think of what you could do with that extra money that’s not going to mortgage payments anymore.

You’ll Be More Disciplined and Motivated

The adage “no pain no gain” really applies here. It can be tough sticking with those higher payments each month, but the hidden benefits is that you’ll have to become more disciplined with your finances AND you’ll likely be motivated to pay off your mortgage earlier. For example, when we got stimulus money from the feds a few years ago, my husband and I took some of that and applied it to our mortgage.

It’s pretty exciting to think that our youngest child is just 18 months old and yet we will have a PAID OFF MORTGAGE in just a few years.

Woo hoo!

Use this handy mortgage payoff tool so you can make a plan to pay off your home loan as quickly as possible.

And while you’re online checking rates and calculating payments, take a break every once in a while and play some educational money games for the whole family. Many of these fun games will reinforce the concepts they’re learning at school.

Our favorites are Treze Coins (which help teach children to count money and feed it into a gumball machine) and Grocery Cashier, which lets you scan, total and make change for items at the store. It was always my dream as a child to be a cashier and use the scanner!

If you’re more the adventurous type, try the LEGO City Build & Protect game. You can dig for LEGO minipieces of different colors to build up your town, collect taxes, beautify the city and even put out fires and stop crime!

Another favorite is Tower Boom, where you have to use carefully placed dynamite to take down a structure. It’s simple to learn but gets quite challenging as the levels progress.

Let me know in the comments if you have any questions or suggestions when it comes to choosing a 15-year fixed mortgage. I wish you all the best with your next home purchase!

Leave a Reply