After making plenty of money mistakes when we were single and first married, my husband and I got on a written budget five years ago and today are happy to have only our mortgage when it comes to debt. There are four important money lessons we want to instill in our children, and I’m thrilled to have found a program for children ages 6 to 11 called Money Savvy Kids that helps reinforce these principles!

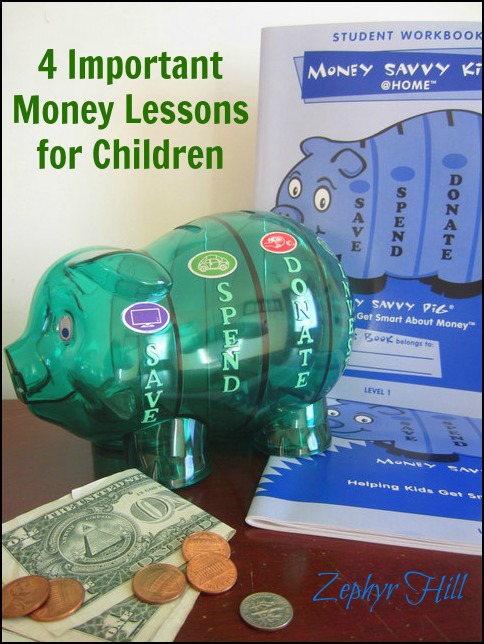

1. Don’t spend any money until you have a plan for it. Even if it’s just five dollars in a piggy bank, school age children can be taught to allot their funds for different purposes. Money decisions take time, and parents can help children with the choices they will face when it comes to buying, donating and investing.

2. Create incentives for donating, investing and saving. Your child will find it easy to spend money on things they want. But it might be difficult to encourage saving, investing or even donating their money. So create incentives like matching their amounts. If they save up $10 for a bike, offer to add another $10. If they accumulate $5 to give to the parish poor box, add $5 of your own to double their donation.

3. The sooner you begin, the sooner money can go to work for you. Don’t delay putting the principle of interest to work; the earlier a child starts a savings account, the bigger the rewards will be later on. (Hint: you can even start a savings account for your newborn baby.)

4. Avoid borrowing when possible. Borrowing from someone else creates a financial burden; you’re never really “free” until that obligation is paid in full, and the more debt you have, the less income you have to work with on pay day. A child can mistakenly assume that borrowing is a quick and easy way to get money, but there’s nothing quick or easy about paying the lender back!

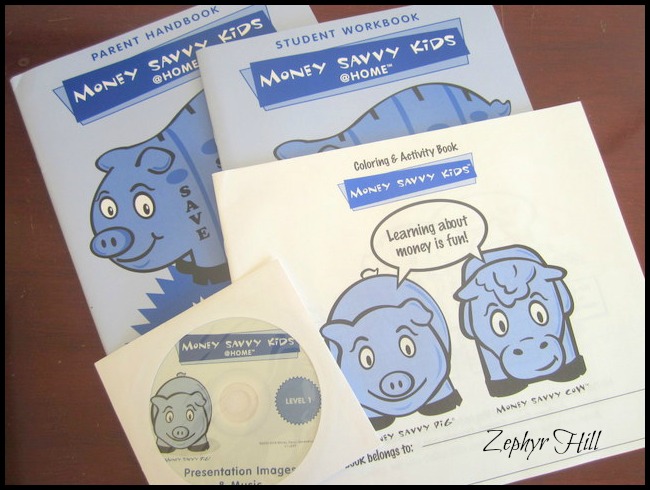

The Money Savvy Kids home edition that we received free to review includes:

- Money Savvy Pig piggy bank and goal setting stickers

- 44 page soft-cover Parent Handbook

- 8 chapter CD-ROM with over 100 color images and four sing-along kids songs about money

- 21 page soft-cover Student Workbook

- 22 page soft-cover Money Savvy Kids Coloring and Activity Book

- 17″ by 22″ When You’re Smart with Money Poem Poster

It retails for $39.99. If you have more than one child that will be using the program, an additional kit containing another bank plus the workbooks and stickers can be purchased for just $23.99.

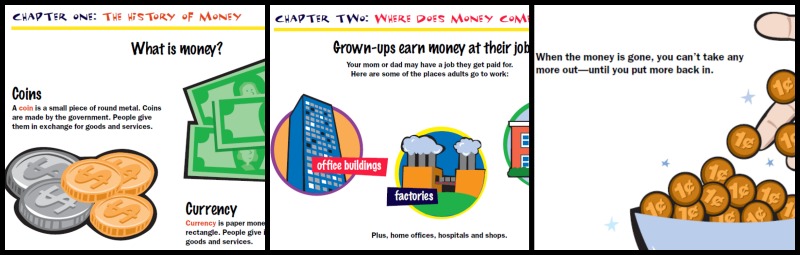

The eight CD-ROM lessons are very enjoyable and easy to understand. Simply pop the CD into your computer and a colorful PDF document opens up that contains all the chapters. I sat with Joseph and Catherine in front of the laptop as we read each lesson aloud. The program starts out very logically with a chapter about the history of money. My children loved learning about the bartering process used in ancient times and as soon as Daddy came home, they shared some facts from the lesson with him.

Here are a few screenshots to give you an idea of how colorful and engaging the lessons are:

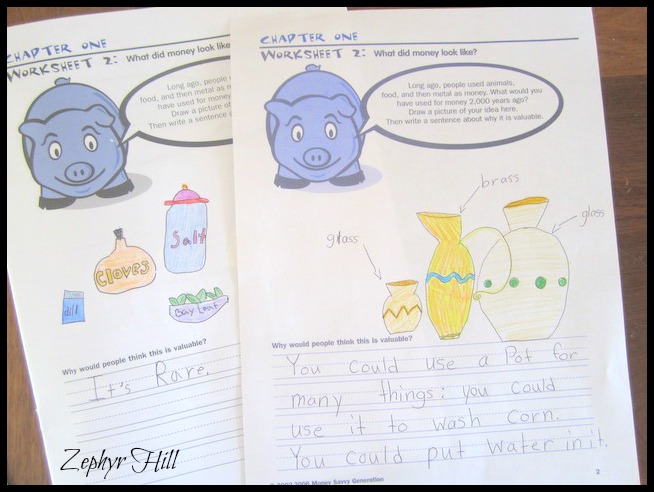

There are fun workbook activities to go along with the lessons:

I personally found the Discussion Guide for Parents to be a great resource as we worked our way through the lessons. The commentaries from Susan Beacham (nationally syndicated finance columnist and founder of Money Savvy Generation) are very insightful. The four songs on the CD are entertaining to listen to, and they are sung by children, so that adds an element of fun. The first, which is about the history of money, was our favorite. Out of all the course materials received, the least-used item would probably be the money poem poster, mostly because it focuses heavily on making and spending money.

It took us about 45 to 60 minutes to complete one chapter plus the corresponding activities. I would say that’s an ideal amount of time for the 6 to 11 age group. You could do 1 lesson a week or even a couple per week. It’s ideal for home learners and private/public school students. Unfortunately, most children aren’t really introduced to financial concepts until high school, yet they deal with money from the time they are very young. Why not start early and get the core principles instilled right off?

Another bonus: doing a program like this with your child at home starts a conversation about money, and that’s an important one to have. Children frequently ask for things (toys, books, clothes, candy, you name it!) and the typical parental response (guilty mama here) is to put them off by saying things like “maybe” or “one day” or “perhaps for your birthday.” When you’ve taught your child some basic money principles like those found in the Money Savvy kids program, your conversations can be more meaningful. You might instead say “you could save up for that toy using your bank. Let’s write down how much it costs and see how much is in that slot when we get home.”

One more thing: as you might imagine, the divided bank is a HUGE hit. All my children want one now! I just ordered a second pig (in purple) for Catherine. Joseph likes that he can see his money grow in the different compartments, and labeling them with stickers was a lot of fun. The bank is big enough that each compartment will hold quite a bit of money. Both coins and currency (folded and creased tightly) can go inside; each foot opens individually at the bottom so you can get the money out.

How your child divides up his money is a plan you can work on together. Everything doesn’t have to be parceled out in four equal shares. As a general rule, we’ve taught ours to put 10% of anything they earn immediately into the “Donate” slot. This is our family’s way of stressing that every material thing we receive is a gift from God, and that we show our gratitude by cheerfully giving some of it back for good causes. The remaining 90% is then apportioned due to circumstances and current financial goals they are trying to reach. Sometimes it’s easiest to just split it 30/30/30, if possible. (Example: my son gets $10 for cutting grandma’s lawn. He puts one dollar into Donate and then $3.00 each into Spend/Save/Invest).

It’s been very rewarding to watch my 10-year-old son take responsibility for his money and make plans for how he will spend it. One of the most wonderful things to see is how he quietly puts the money from his Donate slot into the collection basket at church every so often. There’s no fanfare and no boasting. He’s a little man who’s learning to be a good steward.

Why do I think the divided bank is such a great concept? It’s an excellent visual device to help children understand abstract money concepts. As they portion their money out for different things, they’ll understand that they are responsible for each dollar that comes to them. And using the Money Savvy Kids program, they’ll learn more about what they can accomplish with each of the four goals: SAVE – SPEND – DONATE – INVEST.

You might also check out the Savings Spree iPhone app – available for purchase at the App Store. It reinforces all the sound money principles I’ve covered today in a very fun and addicting game for children!

The great people at Money Savvy Generation want to help your children get smart about money, too! They are giving away a complete home kit to one lucky reader! It includes all the learning materials we reviewed, PLUS a free signature divided bank. Choose from any of the 5 colored pigs, a football, soccer ball, cow or football.

Love the cow!

“You could use it to wash corn in” – I love this very Poite-Sweden answer Been thinking about something like this for Simeon.

Been thinking about something like this for Simeon.

I asked Catherine why she chose corn. Her answer was she had just read a Swahili tale called “The One-Handed Girl.” It’s in one of my Dover fairy books. Crossing my fingers for you and Simeon! ~Anne

Crossing my fingers for you and Simeon! ~Anne

I think I like the blue the best, but the platinum is neat too!

I think my daughter would like the purple pig

This is something I could really use for Ruben right now. He really needs to learn to manage his money. We might get the soccer ball or the cow.

Love the purple pig for my daughter!

I would choose for my son the Football bank.

I think my son would like the Money Savvy Soccer Ball™.

Money savvy Cow! We love cows

Money Savvy Pig – Platinum

We like the platinum pig! What a cool idea!

What a great idea! Pink pig

The blue one for my Gboys !

I would love the platinum one for myself!

The Purple Pig! Love this!

Money Savvy Pig – Green

I like the money savvy pig in green!

We like the blue money savvy pig

So important to teach our kids the value of money. I’d pick the cow!

I would pick the Money Savvy Pig – Platinum

I think I’d have to go with the cow.

He would like the Money Savvy Pig. Most likely in pink.

my son would like the cow!

I think she’d pick pink or purple, because that’s what little princesses do … I think I might see if she’ll like the platinum though … it’s always good to have things in gender neutral colors in case they get passed down.

I think the pig is more appropriate but my son is more of a cow guy.

The pink pig our sweet baby River What a great idea. We are very interested in teaching our children to be entrepreneurs too, so the investing slot is an excellent teaching tool to encourage business exploration!

What a great idea. We are very interested in teaching our children to be entrepreneurs too, so the investing slot is an excellent teaching tool to encourage business exploration!

This is so cute! I think I’d choose the bank in pink or platinum.

I’d pick the money saving pig in blue

demureprincess7(at)gmail(dot)com

I like this. My parents allowed us to “borrow” from them if we had money at home and didn’t have it with us. Basically like using a debit card. We ran a bread business where we milled our own grain and made the bread fresh. My mom came up with the recipes and made the contacts and we had to call customers and make the bread. That was our “allowance”. So pretty much all the money we made was through that. Then we had to give a portion to God, a portion to College, and only a little was spending money. So probably 3 out of ten dollars did we get to spend. That was a great lesson to learn growing up

What a fun and creative way to teach children how to manage money. Thanks for sharing that, Anna! ~Anne

That piggy bank is such a good idea to teach those concepts!